Save your GST Input Tax Credit with Virtual Office

If you have a business that provides goods and services in more than one state, then you will definitely have a hard time filling for your GST input credit. As under the GST regime, the invoicing has to be organized according to the state where the goods or services are sold, Further input tax credit under GST is state-centric.

Simply saying, If you want to Claim your 9% of GST Input Tax Credit then you must have GST registration in the state where you are supplying your goods or services. And for GST registration you will require Office address in each of those states where your are serving.

Now imagine, how expensive would it be to have

What is Input Tax Credit?

Input Tax Credit (ITC) is not just a tax saving mechanism, it is the ultimate tool to accelerate business growth. ITC allows you to pay GST only on the value you add to your products and services, ensuring that your hard-earned money is not lost in unnecessary taxes.

Why ITC is a game changer for businesses

Imagine running a business where every rupee counts. ITC helps you:

– Save a lot: Significantly reduce your tax liability.

– Increase cash flow: Free up funds to invest in what matters most.

– Stay competitive: Increase your prices for your products and services by reducing your overall costs.

How ITC Works: A Simple Formula for Success

Here’s the magic:

– You pay GST when you buy goods or services for your business.

– When you sell a product, the GST you collect may be reduced by the GST you’ve already paid.

– The result? You pay tax only on value-added.

What is Virtual Office?

Virtual Office is a real Business address provided by premium business centres and coworking spaces. With Virtual Office, you can own an office without having to rent a complete physical office space.

You will be provided with professional addresses of premium business centres and coworking spaces at INR 1000-3000 per month. You will get the following documents with Virtual Office,

1) No-Objection Certificate

2) Rental Agreement

3) Address Proof (Utility Bill)

In addition to that, you can also avail of mail handling services and signage at that office address. With Virtual Office you will be able to get your GST Registration across all 29 states in India at a fraction of the cost.

|  |  |

Virtual Office BangaloreStarting at Rs. 1500 per Month. | Virtual Office in DelhiStarting at Rs. 1200 per Month. | Virtual Office in MumbaiStarting at Rs. 1200 per Month. |

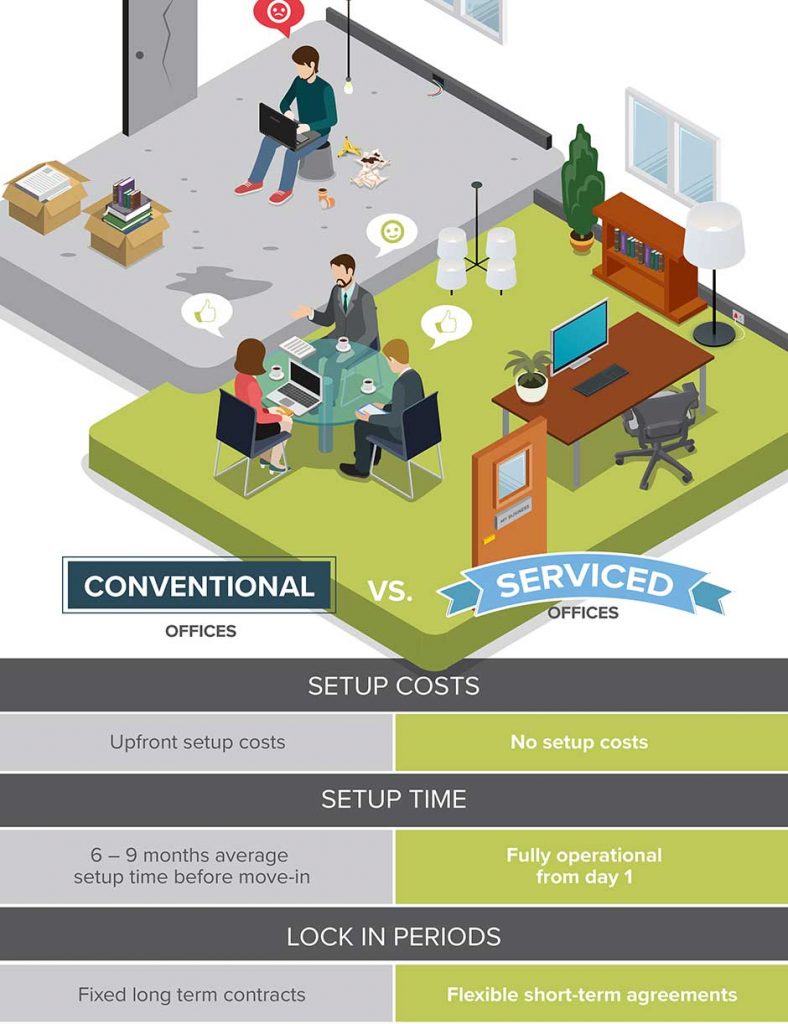

Physical Office vs Virtual Office

FAQs

| What is a Virtual Office and how does it help with GST-ITC? A virtual office gives you a professional business address without the need for a physical workspace. You can use this address for GST registration and claim ITC for purchases and expenses related to your business operations | Can I claim ITC with a Virtual Office? Yes, as long as your Virtual Office is GST-registered and your purchases are used for business operations. Your GST invoice for expenses must reflect your registered Virtual Office address. |

| What documents do I need to claim ITC using a Virtual Office? A GST-compliant invoice with your Virtual Office address. – Proof of payment of GST. – Valid GST registration certificate for your virtual office. | How do I get started with a virtual office for GST? It’s very easy! Just choose a reliable virtual office provider like InstaSapces, complete your GST registration with their address and start saving on ITC. |

Clients Served

|  |  |  |  |

|  |  |  |  |

Reviews

We needed GST registrations for our business in 10 states. Our colleague recommended InstaSpaces from her past experience. When I communicated with their customer service I found them knowledgeable and fast, they satisfied my requirements and were quick with the documentation process. I was happy with there service.

Vijay Kumar

Stay Bazaar

InstaSpaces Team is truly Insta. They provided us solution for Virtual office for GST solutions for 16 states at lighting fast pace. The team is responsive and thoroughly professional.

Avinash Khanna

Book My Show

Got our virtual office business registration done with them in Delhi, i am happy as they provided me a premium virtual office at affordable price with complete legal documentation.

Manpreet Narula

Quick support. We got a notice from GST Authority, as they states that electricity bill wasn’t clear. It got us worried at first, but InstaSpaces was quick to respond and professional, and immediately provided us with clearer copy and Property Tax Receipt as address proof. That was accepted by the GST Authority and our registration was successful. They know the entire GST registration formalities and were quite knowledgeable.

Himanshu Mishra